Julie Ann Wrigley

Global Futures

Laboratory™

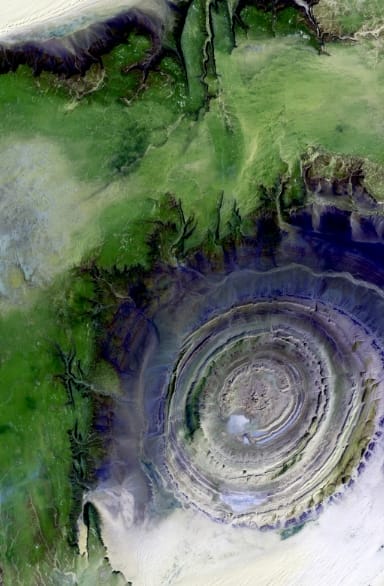

You’re looking at me, but are you really seeing me?

—Earth

Our world is speaking to us, but for too long we have not listened.

To shape a thriving future, we must rediscover our relationship with our planet. We are immersed in the infinite and complex network of systems that make up our world, and our mandate is to keep these systems in balance so that all life on Earth may thrive. This requires a vision for better that brings all of our voices together to craft long-term, sustainable solutions.

The conversation starts here.

Our impact

#1 in the US

ASU has held the #1 ranking for US institutions and top 10 in the world since 2020.

Arizona State University is recognized as an inaugural participant in Times Higher Education’s Impact Rankings, the only global performance tables that assess universities against the United Nations’ Sustainable Development Goals (SDGs).

global impact

– Times Higher Education, 2020 – 2023

sustainability

– Sustainability Tracking, Assessment & Rating system, 2023

innovation

– ASU ahead of MIT and Penn State

News

Futurecast

Global Futures: Futurecast offers a look into our prospective futures through the eyes of the extensive Global Futures Scientists and Scholars Network. Explore what might come in the seconds, days, and years ahead by subscribing.

Our latest issue talks about how we can draw inspiration from the patterns in nature to implement strategic decisions in our built world.

Earth Week

Since 1970, the world has come together each year on April 22 to celebrate our home planet and all that we can and must do to honor and protect it. Please join us this April 22 for a special day here at the Walton Center for Planetary Health, as well as other events throughout the month of April hosted by units and groups across the ASU community.

Applied solutions development

Since 2019, the Global Futures Laboratory has drawn on ASU’s deep commitment to use-inspired research. Our ongoing endeavors in sustainability, responsible innovation and service to the global community in which we live are explored across five core spaces: Discovery, Learning, Solutions, Networks and Engagement. Our work is deployed locally, regionally and globally, through our headquarters on the Tempe campus, our centers in Hawaii, Los Angeles, Washington, D.C., and Bermuda, through our learning and academic home at the College of Global Futures and across our diverse network of partners around the world.

Global Futures is more than sustainability. The Global Futures Laboratory is more than a college or discipline. Our framework is designed to transform complex systems through innovation.

Discovery

Through research across the Global Institute of Sustainability and Innovations, we are understanding earth systems and project into the future.

Learning

At the College of Global Futures, we are exploring new ways to share knowledge with diverse audiences according to their needs and priorities.

Solutions

We are developing solutions for issues such as carbon capture, energy systems, ocean health and waste on multiple scales in close exchange with the people affected by our world’s problems.

Networks

Alongside partners like the United Nations and Conservation International, we are achieving a critical mass of intellectual resources to address challenges that are too big to solve alone.

Engagement

We are convening communities and organizations through programs like Decision Theater and the Global Futures Conference to understand their needs, learn from their knowledge and share ideas.

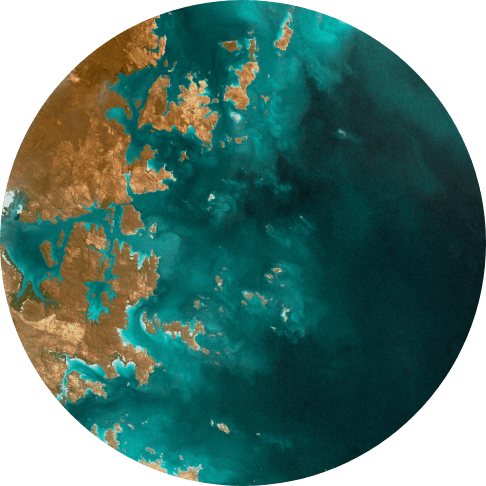

Highlight: Water

We see water as a network that keeps us connected. Our local communities, ecosystems and industry all rely on this valuable resource, and it is our responsibility to ensure our waterways remain healthy. Take a look at what the Global Futures Laboratory is doing to protect water, both in the Southwest and around the world.

Current projects and programs

NSF Engines: Southwest Sustainability Innovation Engine

The Southwest Sustainability Innovation Engine — based at ASU and spanning 54 partnerships across Arizona, Nevada and Utah — is one the first NSF Innovation Engines to accelerate the development of jobs, technologies, policies and solutions by way of green economy and innovation.

Direct Air Capture

Climate change caused the planet’s surface temperature to record levels in the summer of 2023. We must do more to not only stop that warming but begin its reversal. Capturing and removing carbon from our atmosphere is a primary way there. Learn how we are exploring how to do that without using any additional energy in the process.

Global Futures Impact Scholars

Our world needs trailblazers like you. The College of Global Futures invites you to apply to become a Global Futures Impact Scholar, where you will receive funding to support research, study abroad or other opportunities. and Additionally, you will work alongside experts as you design positive change and unlock a world of opportunities! Your impact begins now.

Hydrostation ‘S’

Initiated in 1954, and maintained by the ASU Bermuda Institute of Ocean Sciences, the Hydration ‘S’ mooring has welcomed scientists and researchers biweekly, resulting in the world’s longest-running time-series for physical and chemical oceanographic data, including ocean temperature, salinity, and dissolved oxygen measurements.

The reason we need to change the world is that humankind got out of equilibrium with Earth’s life-supporting systems. We have to understand the decisions that led to that, but also how we can incentivize decisions that are different.